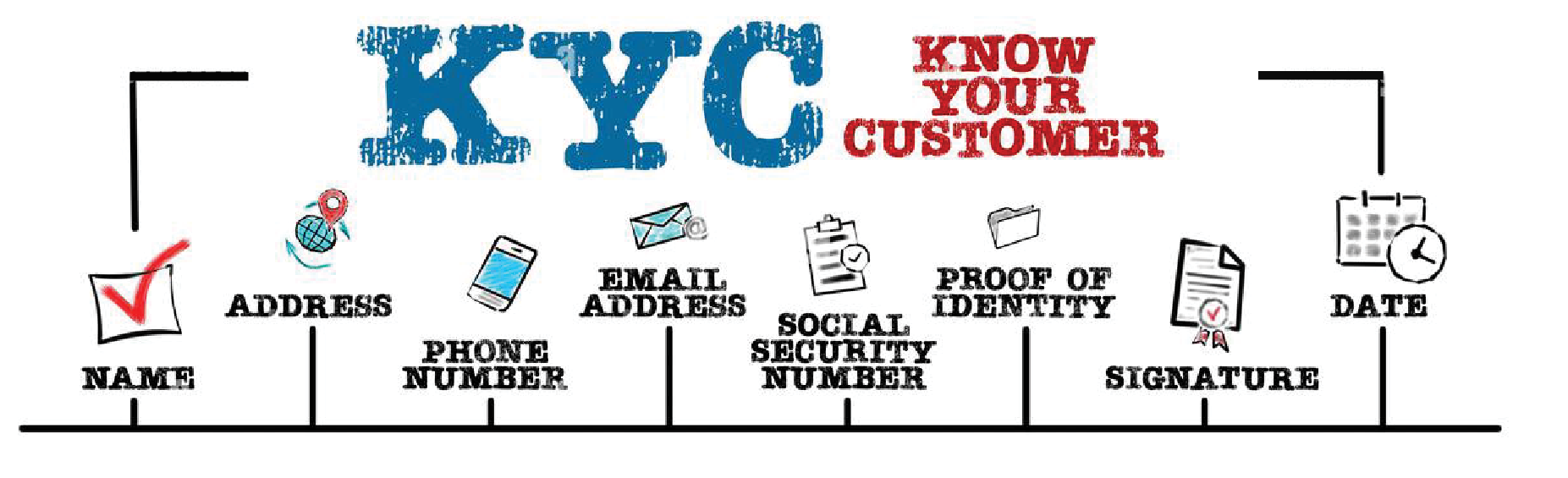

KYC

Know Your Customer

If you are in a business you must be following the age old principle of Know Your Customer (KYC). It is almost impossible for a trader these day to do any business without properly knowing the people that they deal with. One of the necessity of any business in today's day and age is a bank account. Those who deal with bankers must have also heard the term Know Your Customer's Customer. By implementing Know Your Customer's Customer (KYCC) processes, you can identify future threats and ensure your business is well-protected against financial crimes such as money laundering and frauds.

What is Know Your Customer's Customer (KYCC)?

KYCC is an added step beyond traditional KYC. It involves a closer look of the organizations you do business with. With KYCC, you not only look at your customer but also try to get some information on the business your customers deal with. The objective of KYCC is to: similar:

- Ensure the people you deal with and their counter parties are not involved in anything that can hurt your business for any reason.

- Ensure your customers are not providing any services that may be questionable or detrimental to your business in the jurisdiction you operate.

A message will appear confirming that the registration was successful. Please proceed to Google Play and on the App Store. Please contact 800-HABIB (42242) at any time for clarifica-tion on the registration process.

Why is KYCC important?

KYCC measures can protect your business, customers, and the global economy against money laundering, and other illegal financial activities.

Not all the countries have introduced regulations requiring or recognizing the importance of KYCC. By proactively implementing KYCC procedures, you'll protect your business from being a participant in anything suspicious.

KYCC is particularly important if you operate in high-risk industries such as trading in dual purpose goods or high value commodity.

What does KYCC look like?

KYCC is very similar to KYC. The difference here is that here you gathering basic and general information your customer's customers, not your customers. Like KYC, there are three essential steps in KYCC:

| IDENTIFICATION | DUE DILIGENCE | ONGOING MONITORING |

To begin KYCC, you'll will need a list of customers from each of your customers. The countries from which your customers are procuring raw material. This is not an easy task to gather such data or information

A robust KYCC process improves both your and your customers' businesses. It helps raise business standards, establish improved compliance measures, and increase trust and safety. Ultimately, working together on KYCC can build an excellent reputation for both you and your customer.

By putting KYCC processes in place now, you can proactively be protecting yourself against fraud, money laundering, and other financial crimes. You'll also guard your business against reputational risk and may be able to avoid costly legal troubles in future

Practical Applications of KYCC

Retail Supply Chains:

A large retailer uses KYCC to vet suppliers of raw materials. Through this process, the retailer learns that one supplier is sourcing materials from regions with known human rights violations. As a result, the retailer decides to switch suppliers to maintain ethical standards and protect its reputation..

Technology Companies:

A software provider implements KYCC to understand the end-users of its business clients. This helps the company detect potential data security risks associated with high-risk industries or regions, enabling it to enforce stricter access controls and compliance measures.